In SAP, a Chart of Accounts (COA) is a structured list of all General Ledger (G/L) accounts used by a company or group of companies. Each account in this list serves a unique purpose and helps ensure that financial reporting is accurate and organized. Understanding COA is essential for preparing financial statements and analyzing financial data effectively.

In this guide, we’ll explore:

- The three types of charts of accounts.

- A step-by-step process for creating a chart of accounts in SAP.

What is a Chart of Accounts (COA) in SAP?

The COA is essential for financial reporting, both for internal management and external reporting. It’s created at the client level and then assigned to individual company codes.

Here are the three types of COA used in SAP:

- Operating Chart of Accounts: The main COA for recording daily transactions (like revenue and expenses) in both the Finance and Controlling modules.

- Group Chart of Accounts: A standard COA for all entities within a corporate group, ensuring consistency in reporting.

- Country-Specific Chart of Accounts: Tailored to meet local legal requirements in specific countries.

Step-by-Step Guide to Creating a Chart of Accounts in SAP

Let’s go through each step to set up a new COA in SAP.

Step 1: Access the SAP Customization Area

To begin, open SAP and enter the transaction code SPRO in the command field. This brings you to the SAP Reference IMG, where you can configure many of SAP’s features.

Step 2: Navigate to the Chart of Accounts Settings

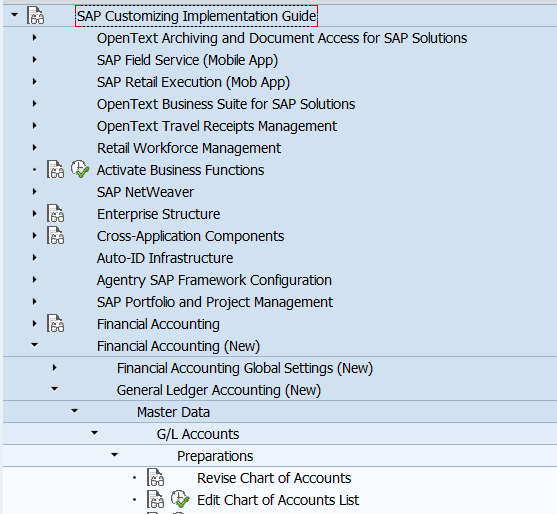

Within the SAP Reference IMG, follow this path to access COA settings: SAP Customizing Implementation Guide -> Financial Accounting -> General Ledger Accounting -> G/L Accounts -> Master Data -> Preparations -> Edit Chart of Accounts List

Step 3: Create a New Chart of Accounts

Click on New Entries to start creating a fresh chart of accounts.

Step 4: Fill in the Required Data

Now, you’ll need to enter the following details for your new COA:

- Chart of Accounts Code: A unique code (up to 4 characters) that identifies this COA. Examples: “OPER” for an Operating COA or “GRUP” for a Group COA.

- Description: Provide a brief description of the COA, like “Operating COA for ABC Corp.”

- Language: Set the language you’ll use for account names and descriptions.

- Maximum G/L Account Number Length: Define the maximum length allowed for G/L account numbers (typically 6 or 8 digits).

- G/L Account and Cost Element Integration: Specify the integration type if using Controlling module integration.

- Corporate Group COA: If this COA is used for a corporate group, mention it here.

Step 5: Save Your Changes

After entering all necessary information, click Save. SAP will prompt you to enter a change request number—this helps keep track of all configuration changes.

Conclusion

You’ve now successfully created a new chart of accounts in SAP! Following these steps ensures a solid foundation for financial reporting and analysis.

Creating a COA may seem complex, but it’s a fundamental skill for managing financial data in SAP. This guide simplifies each step so that you, as a beginner, can confidently create and configure a chart of accounts for your company.